Currently, the financial system presents two blockchain-based controlled and decentralized systems. To buy, sell, earn, and engage in cryptocurrency asset trading, stakeholders must decide for themselves. But, why pick one over the other when you may have both in one?

What is CeDeFi?

CeDeFi refers to a centralized decentralized finance system that features both financial systems together creating a hybridized approach.

CeDeFi showcases the advanced combined characteristics of both CeFi and DeFi. It promises several distinctive ways to enable crypto-savvy, secure exchanges while allowing high liquidity projects.

In September 2020, the CEO of Binance first introduced the acronym CeDeFi during the launch of Binance Smart Chain. For instance, users prefer smooth accessibility with DeFi and security control similar to what CeFi provides.

Now, CeDeFi allows companies to utilize DeFi products and its services. These include decentralized exchange platforms (DEX), lending protocols, liquidity pools, and others that can help lower transaction costs.

It enables smart contracts ranging services from one platform to another eliminating business risk and speeding up the transaction process. Using CeDeFi, users can easily benefit from liquidity, depth, transaction, network, and withdrawal fees. It allows KYC stipulations to discover the right asset, reduce slippage, and secure transactions.

CeDefi acts as a middle ground, surpassing restrictions imposed on cryptocurrencies. It allows traders and companies to use regulated security tokens. This platform can easily change the landscape of global payments, making them functional and affordable to use.

Centralized Decentralised Finance adds growth to crypto impacting the traditional market impacting smooth trading, and high liquidity projects.

Are you looking for a top DeFi development company to help you create a CeDeFi platform? Click here to get in touch with us. We provide dApp development services that guarantee efficient transaction processes.

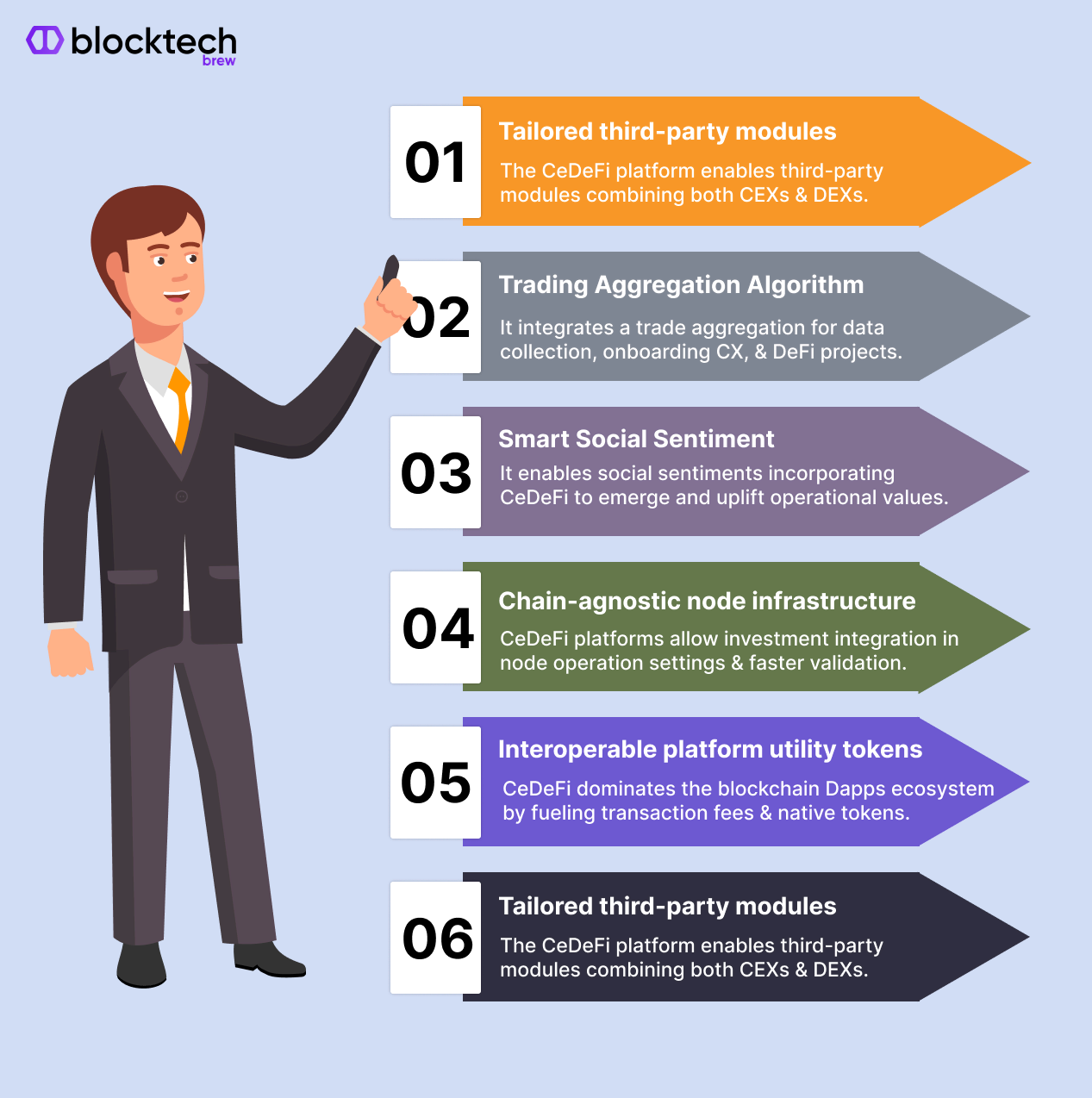

Key Features of CeDeFi Technology

Tailored Third-Party Modules

The order book of centralized exchanges integrates into CeDeFi platforms using third-party modules because of CeDeFi technology. CeDeFi combines both CEXs and DEXs to provide its users with pooled liquidity.

Trading Aggregation Algorithm

This cutting-edge technology, which incorporates a trade aggregation mechanism, will increase the adaptability of CeDeFi platforms.

It guarantees data-collection-intensive trading from original CX, onboarded CEXs, and DeFi projects, as well as bespoke and third-party modules.

The trade aggregation method allows CeDeFi systems to provide efficient transaction execution and settlement.

Smart Social Sentiment

The CeDeFi platform considers the role of sentiments and their impact analysis in the crypto market. Smart social sentiments incorporate CeDeFi tech to emerge and uplift operational value.

To provide CeDeFi users with the greatest value over social sentiments CeDeFi platforms are developing components that enable custom indexes that track the state of general crypto and market segments.

Chain-agnostic node infrastructure

CeDeFi platforms enable massive investments in node operational infrastructure. Running these nodes enables faster validation of the blockchain. It reduces time while transacting and assists in the chain for faster confirmation. Participating in the direct CeDeFi consensus process helps set competitive staking rewards for its users.

Interoperable platform utility tokens

CeDeFi projects create a platform for token-supported tokenomics. Based on deflationary factors, it dominates Ethereum’s blockchain in the Dapps ecosystem. It mirrors the Binance smart chain concept, which converts into a BEP-20 token using ERC-20 to BEP-20 bridges.

It fuels innovation with the CeDeFi ecosystem’s transaction fees and platforms’ native tokens. For vetted participation, it enables governance, DAO, staking, and seed funding for early-stage projects.

DAO Governance

CeDeFi offers core decentralization components with decentralized governance. This platform pioneers new organizations structuring commercial entities and quasi-anonymous DAO work. It helps determine, influence, and control the direction of financial institutions.

How Does it Work?

The CeDeFi platform embodies the best aspects of decentralized financial systems. It makes lending, borrowing, exchanging, and using stablecoins simple.

Additionally, it has access to well-functioning, centralized finance. DeFi is significantly less secure than centralized decentralized finance (CDF). It doesn’t rely only on blockchain technology.

By offering an incredibly better user experience, CeDeFi combines the benefits of both DeFi and CeFi.

Benefits of CeDeFi

CeDeFi enables the creation of new tokens using smart contracts, allowing users to rely only on platforms for loans and borrowing and securing derivatives trading.

Higher Accessibility: People who access the Ethereum wallet can efficiently utilize centralized decentralized finance.

More Flexibility: Using centralized and decentralized protocols, CeDeFi can easily allow the development of various derivative products.

Fail-Safe Mechanism: CeDeFi protocols are led by Ethereum technology and are single-point of failure resistant.

Interoperability: CeDeFi has strong connectivity to communicate over several Ethereum-based protocols.

Lower risks of fraud: CeDeFi only offers projects that have been thoroughly reviewed, increasing the likelihood that fraud and other criminal activity get slowed.

Easy Deployments: Dapp allows developers to function over cross-chain functionalities by swiftly integrating application features.

Top CeDeFi Projects To Know More About

Binance Smart Chain

Binance Chain is among the largest crypto exchange platforms and a visionary for CeDeFi. It tackles the problem of blockchain scalability.

Binance enables a Proof of Stake Authority (PoSA) consensus mechanism and offers reliability, safety, and security.

Additionally, it commands strong compatibility with Ethereum Virtual Machines (EVMs) facilities’ performance level in the CeDeFi landscape.

OpenOcean

OpenOcean is also another CeDeFi project that is gaining popularity among traders. It is the world’s first aggregation protocol, enabling cross-chain swaps and trading liquidity. This platform allows APIs and a customizable trading interface. It aggregates DEXs and CEXs across Ethereum, the Binance smart chain, Solana, HECO, Ontology, and TRON.

Coinzoom

A CeDeFi crypto exchange platform called Coinzoom facilitates simple trading in more than 30 digital assets. It also allows Visa debit cards for crypto spending.

It bridges the gap between traditional finance and the new crypto world through Zoom. Its Ethereum-based token enables users to interact in a decentralized ecosystem.

It supports earning with a lot of DeFi benefits with a hybrid infrastructure that combines both CeFi and DeFi.

FAQs

What is CeDeFi?

CeDeFi is an innovative combination of DeFi and CeFi that can seamlessly integrate the advantages of both types of services. Compared to typical DeFi platforms, it guarantees top-notch DeFi services including loan, liquidity, and yield farming.

How does CeDeFi work?

CeDeFi is a consolidated network that better integrates the products across networking. It allows easy and faster updates, lower transaction costs, and more liquidity. Its decentralization allows users to access it across countries.

What are the advantages of CeDeFi?

- Comparable platforms’ transaction costs are significantly higher than those of CeDeFi systems. In contrast to conventional banking systems, it enables strong security that is challenging to infiltrate into the CeDeFi network.

- Everyone can readily use CeDeFi. Anyone with access to the Ethereum wallet can use CeDeFi protocols with ease. It doesn’t have entry hurdles for less experienced users.

- These platforms can adapt to the needs of users. It is now simpler to utilize greater benefits due to the integration of CeFi and DeFi services.

- Users can quickly obtain a detailed roadmap of their lending, borrowing, or staking activities. These changes to CeDeFi platforms provide total control and transparency over operations.

What are the examples of CeDeFi protocols?

CeDeFi protocols include MakerDAO, synthetic, and compounds that are capable of sharing De-Fi-like capabilities. These platforms are all built on top of the Ethereum blockchain.

I am the CEO and founder of Blocktech Brew, a team of blockchain and Web 3.0 experts who are helping businesses adopt, implement and integrate blockchain solutions to achieve business excellence. Having successfully delivered 1000+ projects to clients across 150+ countries, our team is dedicated to designing and developing smart solutions to scale your business growth. We are focused on harnessing the power of Web 3.0 technologies to offer world-class blockchain, NFT, Metaverse, Defi, and Crypto development services to businesses to help them achieve their goals.